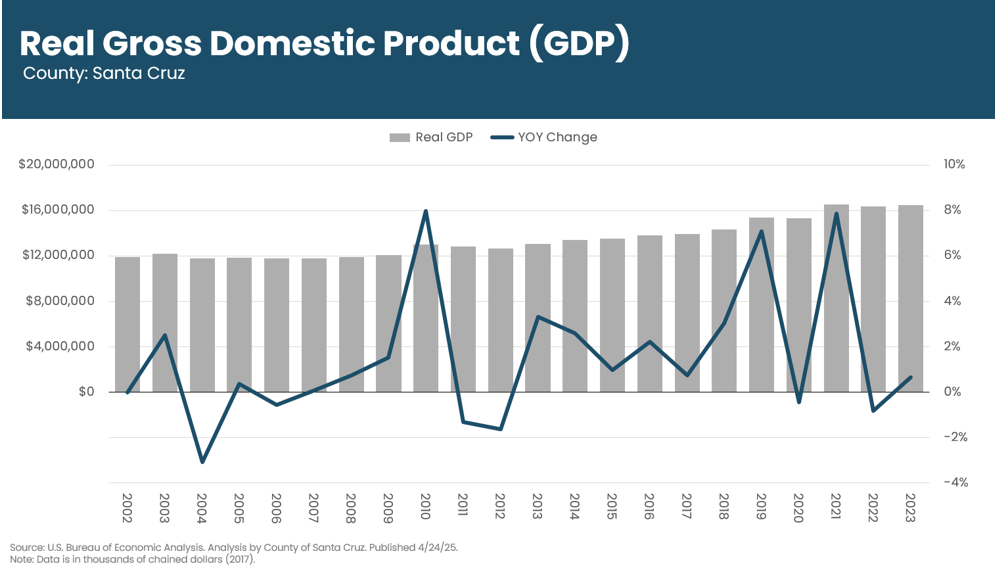

Economy: Real Gross Domestic Product (GDP)

Real Gross Domestic Product (GDP) measures the total value of goods and services produced in Santa Cruz County and is a key indicator of local economic health. After a sharp drop during the pandemic, real GDP rebounded strongly in 2021 with a 7.9% increase but has since flattened—contracting slightly in 2022 and growing by just 0.7% in 2023 to reach approximately $16.5 billion. This trend suggests a cooling local economy, which may affect job growth, consumer spending, and future tax revenues.

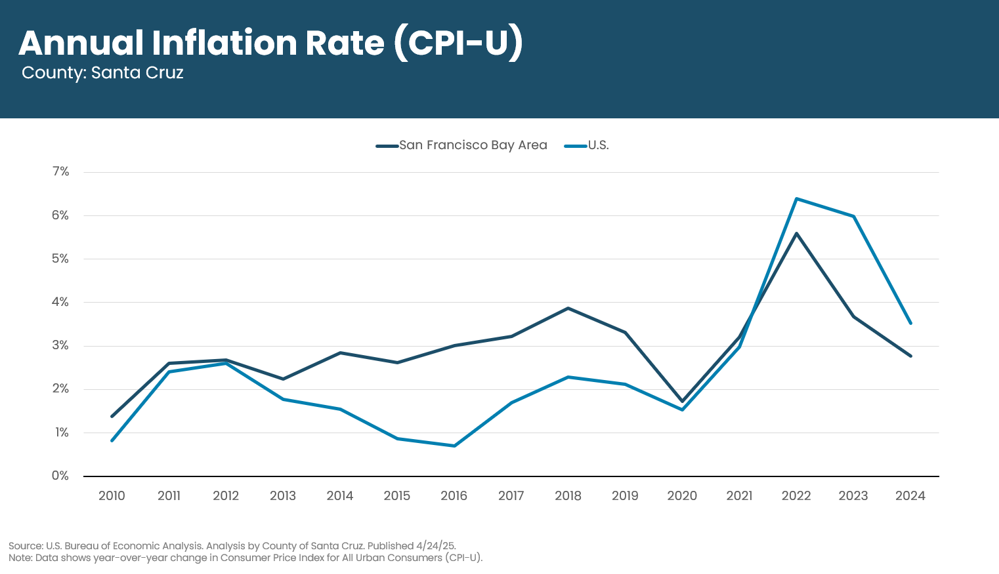

Economy: Annual Inflation Rate (CPI-U)

The Consumer Price Index (CPI) tracks changes in the cost of living by measuring prices for everyday goods and services. In most years, the Bay Area has experienced higher inflation than the national average, driven largely by rising housing and energy costs. Inflation spiked to 5.6% in 2022, then began to cool, dropping to 3.7% in 2023 and further to 2.8% in 2024. Despite this progress, the Bay Area continues to face higher inflation than it did for much of the past decade, and lingering cost pressures still impact household budgets and public service delivery.

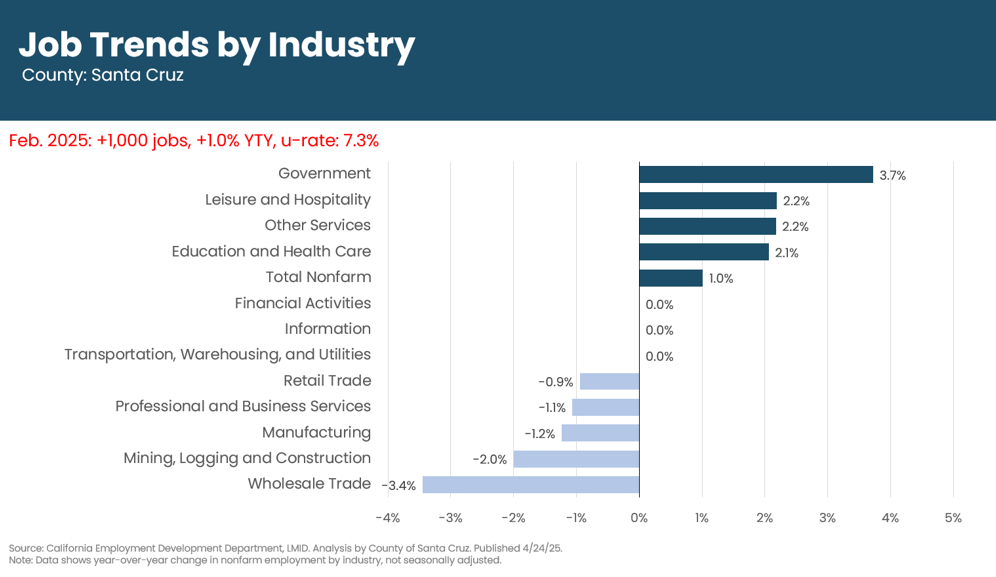

Economy: Job Trends by Industry

Job growth by industry helps show which parts of the local economy are expanding or contracting. As of early 2025, nonfarm employment in Santa Cruz County has increased by 1.0%—equivalent to 1,000 new jobs. Gains have been strongest in Government, Education and Health Care, and Leisure and Hospitality, while sectors like Construction, Retail, and Professional and Business Services have experienced declines—reflecting both public sector hiring and softness in consumer-driven and white-collar industries. These shifts affect the County’s economic resilience, workforce availability, and the types of services in demand.

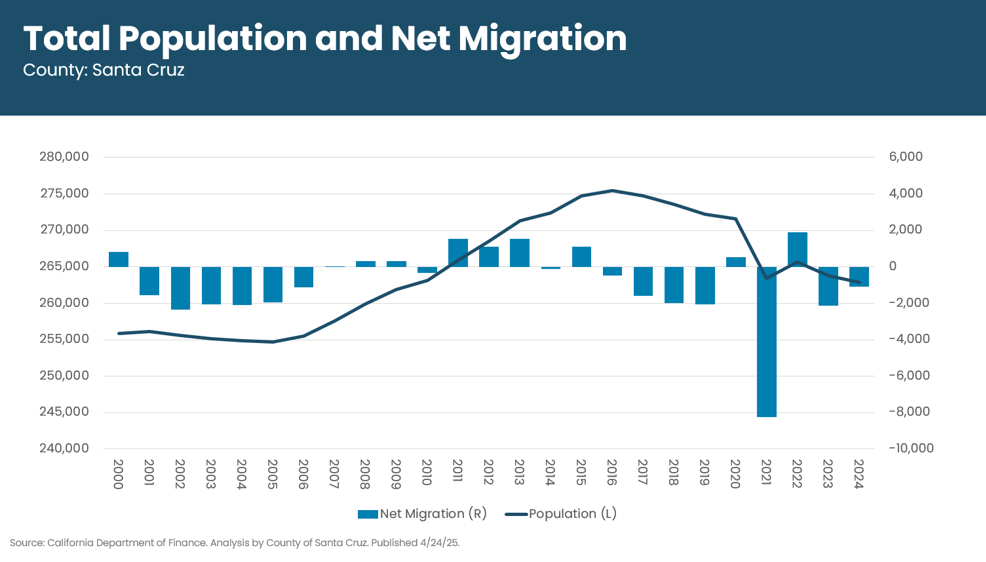

Demographics: Total Population and Net Migration

Population trends help the County understand long-term changes in service needs, housing demand, and workforce availability. While the County’s population grew steadily for many years, it has declined by more than 8,700 residents since 2020, with the steepest single-year drop—over 8,100 residents—occurring in 2021. This decline has been driven primarily by net out-migration, as residents sought more affordable housing or relocated due to remote work flexibility. The pattern highlights ongoing affordability challenges and signals potential shifts in tax revenues, school enrollment, and infrastructure planning.

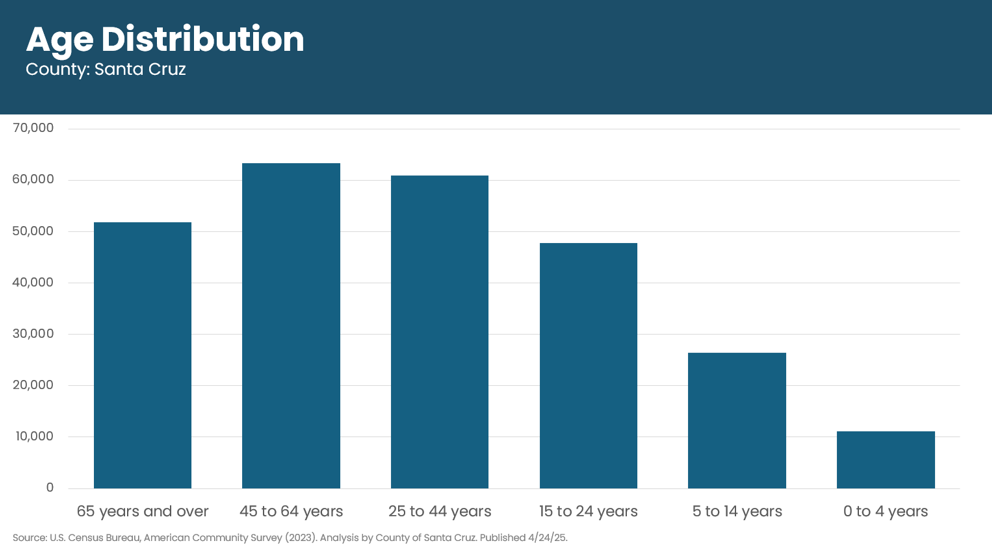

Demographics: Age Distribution

Understanding the age makeup of the population helps the County plan for everything from schools to senior services. Santa Cruz County has a relatively large share of older adults and middle-aged residents, with more than half the population aged 45 and over. In contrast, children under age 15 make up less than 10%, underscoring a shrinking younger population. This aging trend has implications for the future workforce, demand for health and social services, and long-term community planning.

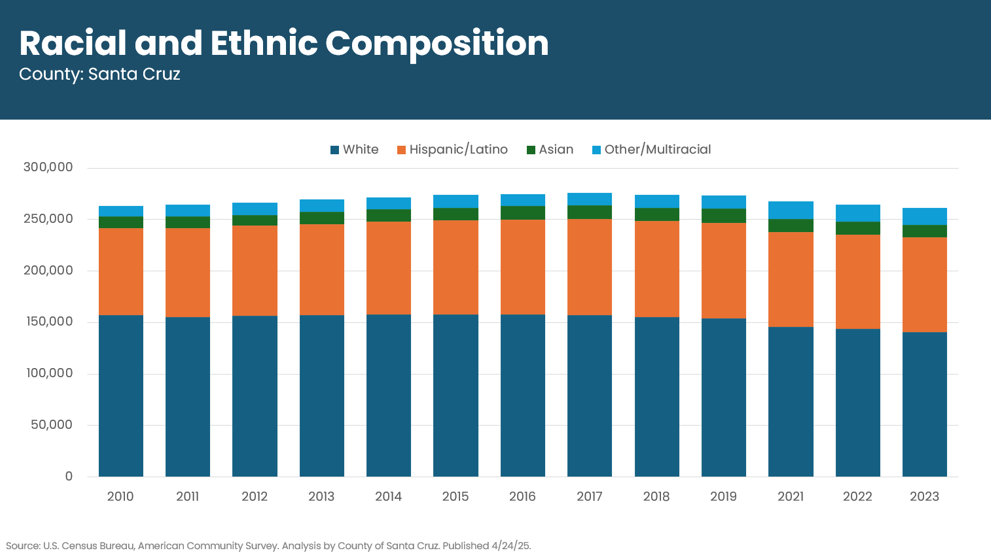

Demographics: Racial and Ethnic Composition

Santa Cruz County’s population remains majority White, but the number of White residents has declined by more than 16,000 since 2010. Meanwhile, the Latino population has grown steadily—now representing over one-third of the county. Asian and multiracial populations have remained relatively small but have increased slightly in recent years. These demographic shifts highlight the importance of culturally responsive services, language access, and equity in education, health, and housing.

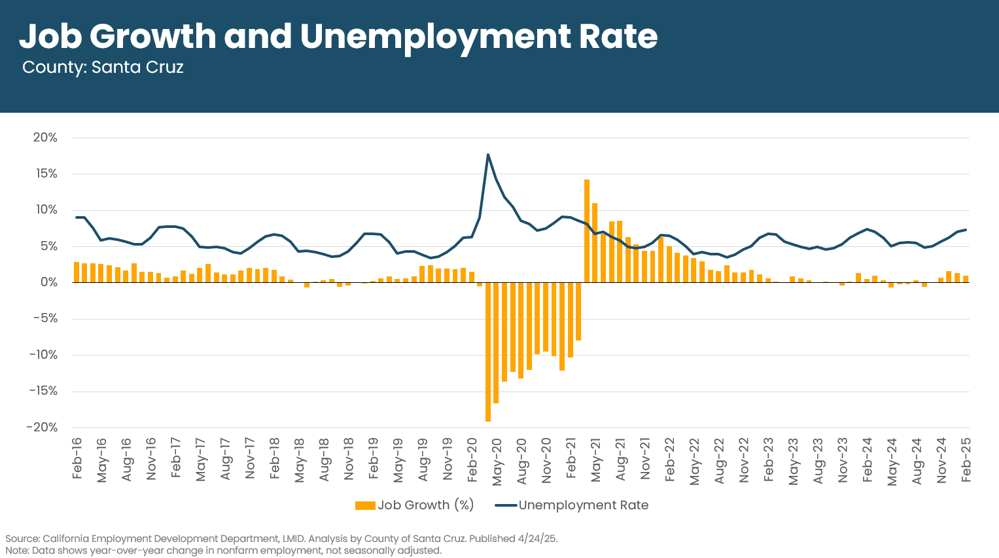

Labor Market: Job Growth and Unemployment Rate

Job growth and unemployment rates are key indicators of the local labor market’s health. As of February 2025, Santa Cruz County’s unemployment rate has risen to 7.3%, up from 4.8% a year earlier, while year-over-year nonfarm job growth remains modest at just 1.0%. This reflects a constrained hiring environment where employers face economic uncertainty and sector-specific challenges. The growing gap between job openings and available talent may signal a mismatch in skills, potentially increasing demand for workforce development programs, job training, and employment services.

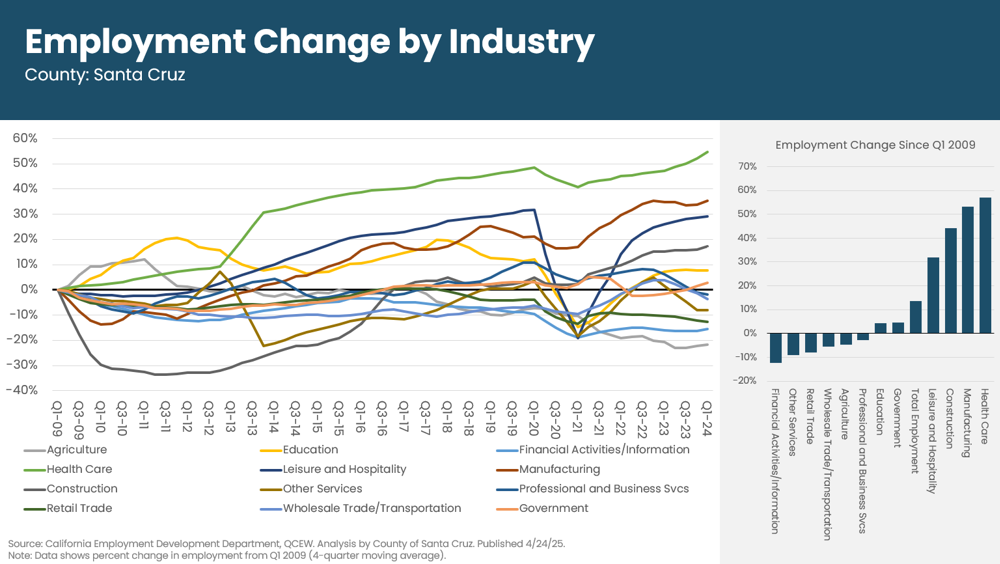

Labor Market: Employment Change by Industry

Tracking employment growth by industry over time helps show how the local economy has evolved. Since 2009, Santa Cruz County has seen the strongest job gains in Health Care (+57%), Manufacturing (+53%), and Construction (+44%), indicating robust growth in both service-based and goods-producing sectors. Meanwhile, Retail Trade (-8%), Financial Activities (-12.4%), and Professional and Business Services (-2.7%) have declined. These long-term shifts shape the County’s economic base and inform workforce development, land use planning, and revenue forecasting.

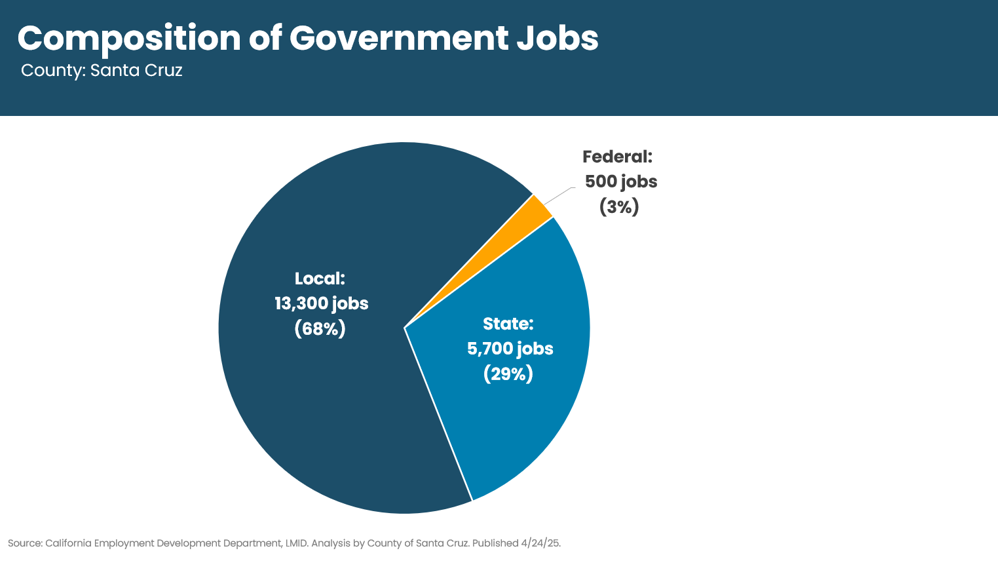

Labor Market: Composition of Government Jobs

Government employment supports a wide range of public services and is a major part of the local workforce. The majority of government jobs in Santa Cruz County are at the local level (68%), with smaller shares from state (29%) and federal (3%) agencies. Because federal employment makes up a small share locally, federal job cuts would have limited direct impact on the county’s labor market.

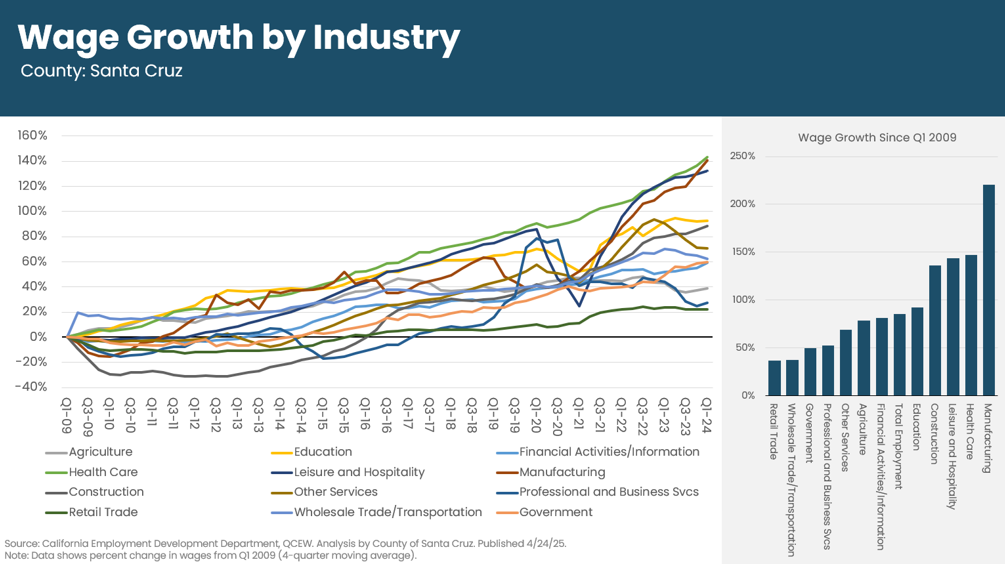

Labor Market: Wage Growth by Industry

Wage growth by industry highlights how income levels have shifted across the local economy over time. Since 2009, wages have grown most in Manufacturing (+221%), Health Care (+147%), and Leisure and Hospitality (+144%), reflecting rising demand for both skilled trade and frontline service workers. In contrast, wage growth has been more modest in sectors like Retail (+37%), Government (+50%), and Professional and Business Services (+52%). These patterns shape household income, contribute to cost-of-living pressures, and influence the County’s ability to attract and retain workers in lower-wage sectors.

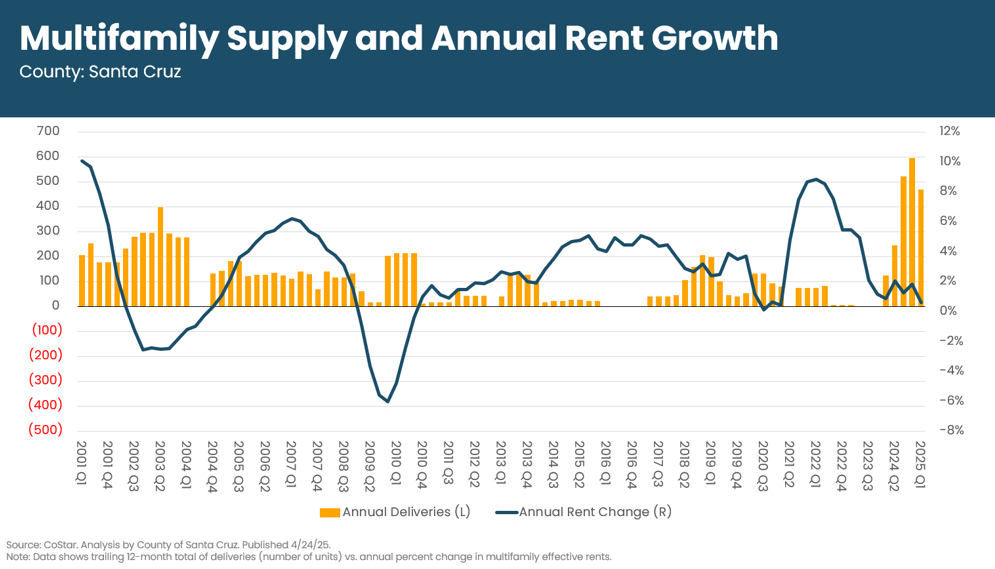

Housing: Multifamily Supply and Annual Rent Growth

Tracking new apartment construction alongside rent trends helps illustrate housing supply and affordability pressures. In Santa Cruz County, rents surged in 2021 and early 2022, with three consecutive quarters of annual growth above 8%, while new deliveries remained limited. Since early 2024, 594 new units have been delivered to the market, reflecting projects initiated during the post-COVID low-interest rate period. This lag between rent spikes and supply underscores how delayed development can exacerbate affordability challenges and highlights the importance of streamlining housing production.

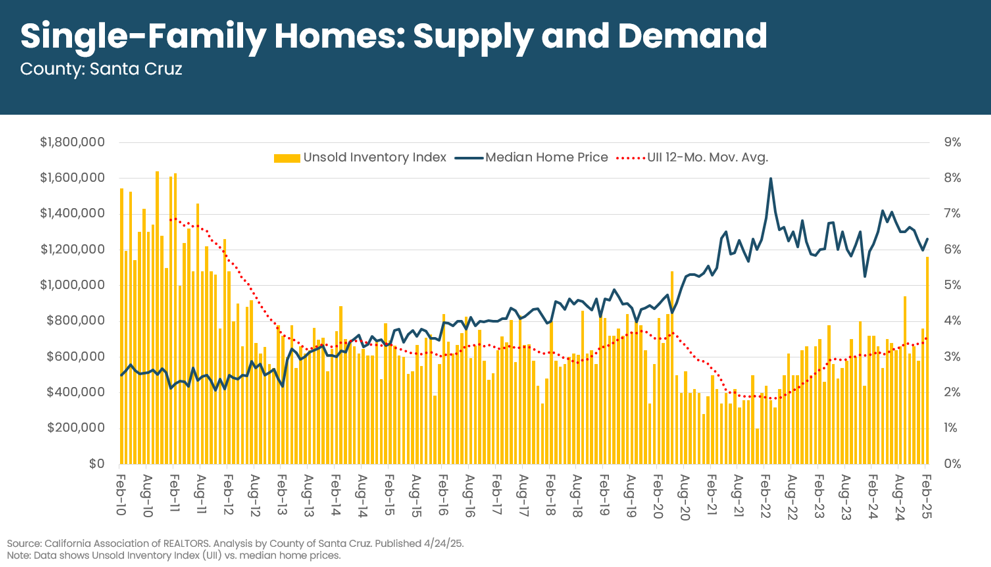

Housing: Single-Family Homes: Supply and Demand

Single-family home prices and inventory levels help illustrate the balance between housing supply and demand. In Santa Cruz County, the median home price reached $1.42 million in April 2024—nearly triple the $495,000 recorded in January 2010—while the unsold inventory index has consistently hovered around 3%, far below a balanced market. This persistent mismatch between supply and demand has made homeownership increasingly out of reach and continues to push more households into the rental market, adding pressure to multifamily housing and overall affordability.

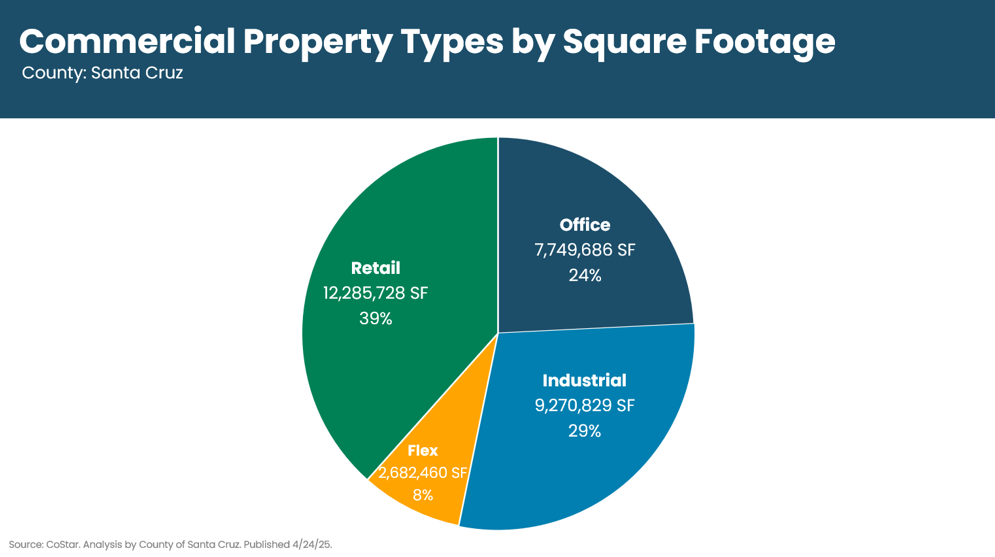

Commercial Space: Commercial Property Types by Square Footage

The composition of commercial real estate reveals how space is utilized across the local economy. In Santa Cruz County, retail accounts for the largest share with over 12 million square feet of commercial space, nearly double the square footage of office properties—underscoring the region’s reliance on tourism, consumer services, and small business activity. Industrial and flex spaces make up smaller but still significant shares, shaping infrastructure demands and influencing how the county plans for future economic development.

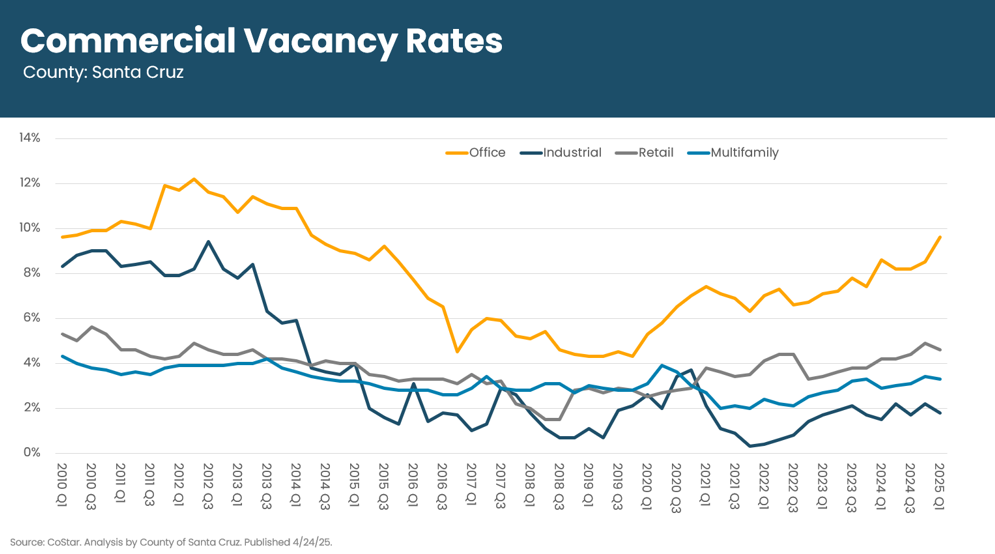

Commercial Space: Commercial Vacancy Rates

Vacancy rates indicate how much space is available in the commercial real estate market and can signal economic shifts. In Santa Cruz County, office vacancies have steadily risen, reaching 9.6% in Q1 2025, nearly doubling from a post-pandemic low of 4.3% in 2019. This reflects ongoing remote work trends and shifting demand for traditional office space. In contrast, industrial and retail vacancy rates remain low at 1.8% and 4.6%, respectively, suggesting tighter markets and sustained demand. Meanwhile, multifamily vacancies, at 3.3%, continue to signal limited housing supply and persistent rental demand.

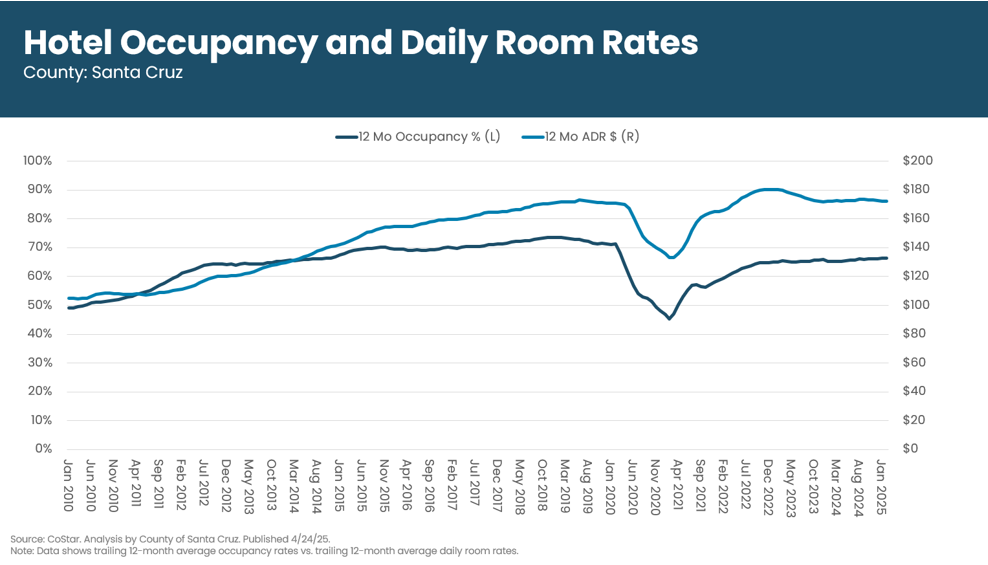

Commercial Space: Hotel Occupancy and Daily Room Rates

Hotel occupancy and room rates help measure the strength of the local tourism and hospitality sector. In Santa Cruz County, 12-month average occupancy has climbed steadily from a pandemic low of 45.2% in February 2021 to over 66% as of February 2025, while average daily room rates (ADR), also shown as 12-month averages, have risen from $133 to over $172. This rebound reflects the sector’s resilience and sustained visitor demand—important drivers of local employment and transient occupancy tax revenues.