The April 24, 2025 Message was updated to reflect additional information on Federal and State impacts as of May 20, 2025 and to include the final Adopted Budget amounts as of September 2025. Otherwise, the discussion was left unchanged to provide the reader with a sense of the County’s budget as it was being finalized.

The Adopted 2025-26 Budget provided for expenses of $1.35 billion offset by revenues of $1.26 billion and $0.09 billion in direct fund contributions while eliminating 54.80 full-time equivalent (FTE) positions to a total of 2,743.76 FTE positions.

The largest fund included in the County budget was the General Fund. The 2025-26 General Fund Budget was balanced with $824.3 million in expenses, $816.3 million in revenues and $8.1 million in planned carryover of prior year fund balance. The budget maintained General Fund reserves at 12.5% or $99.6 million, but below the 15% target and the 28% peer average.

New in the Adopted Budget was the County’s five-year, 2025-2030 Capital Improvement Plan and richer details within each department’s budget, including discussions on emerging issues, highlighting key accomplishments in addition to progress on operational objectives, and discussion of the major changes across all divisions. The budget also included a new Debt Overview intended to summarize the County’s debt including information on liabilities like pensions and claims liabilities.

The Budget was published on April 24, 2025, and presented to the Board of Supervisors on April 29, 2025. While the County had much to celebrate over the past year as seen within the hundreds of departmental accomplishments and completion of operational plan objectives, it faced headwinds in the form of reduced health care funding, delayed disaster reimbursements, state budget uncertainty stemming from larger worldwide economic uncertainty, and uncertainty over shifting priorities in Washington, D.C. and threats to federal funding.

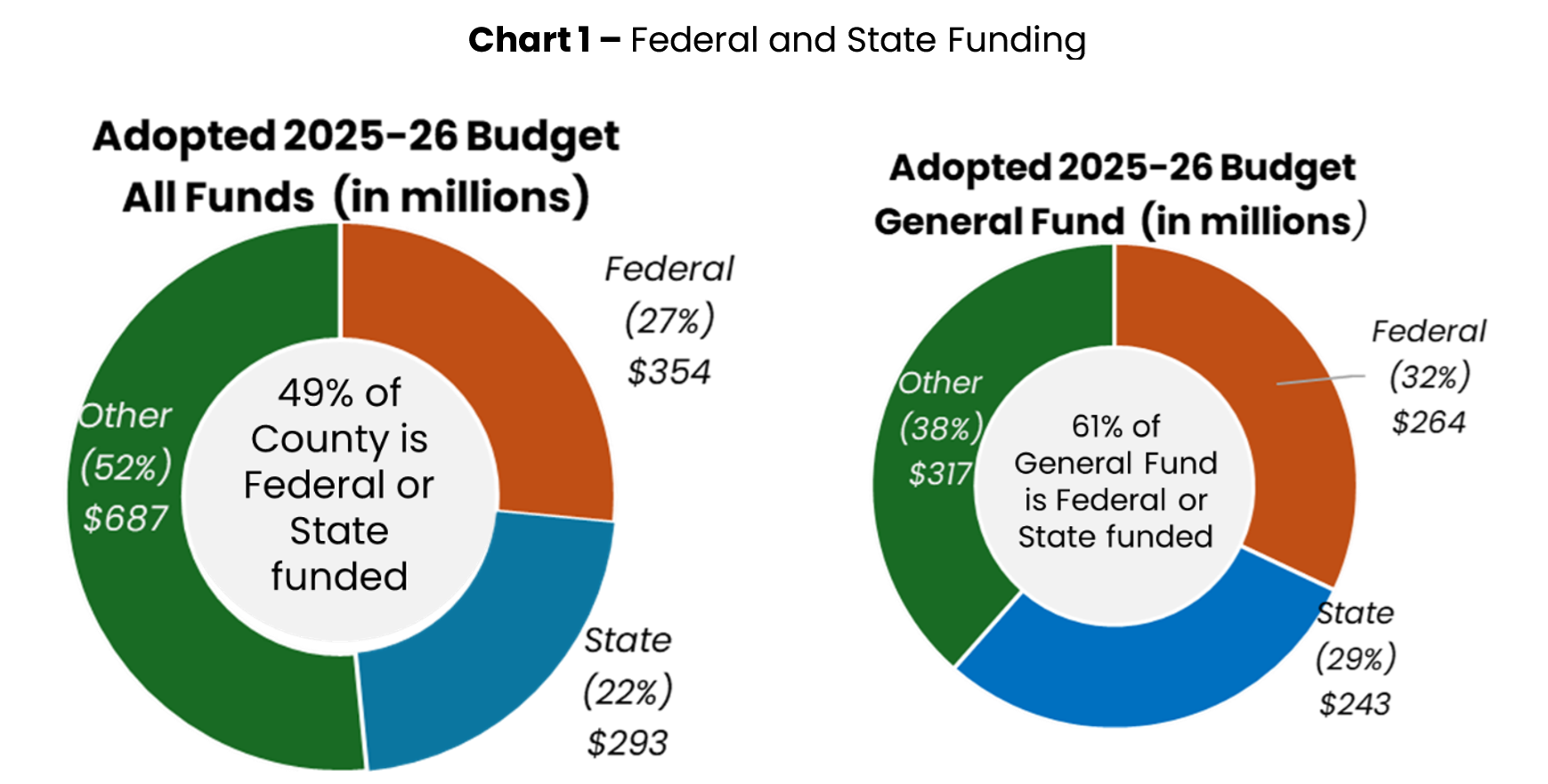

In response, this budget prioritized mandated services, protected essential programs, and made strategic investments in the County’s future. And although it was presented amid the aforementioned headwinds, it did not yet reflect any significant budget impacts from changes in federal policy. The County’s exposure to federal funding and policy risk was significant as nearly half of the budget and 61% of the General Fund Budget is funded with federal and state revenue as shown in Chart 1.

Continued engagement with state and federal partners, local scenario planning, and strategic reserve management would be critical to navigating this uncertain environment. Absent action, federal policy changes could result in multi-million dollar funding losses, operational disruptions, and negative impacts on the health, safety, well-being, and civic participation of tens of thousands of County residents. The County would return to the Board at such a time when a response was required in alignment with development of the Federal budget.

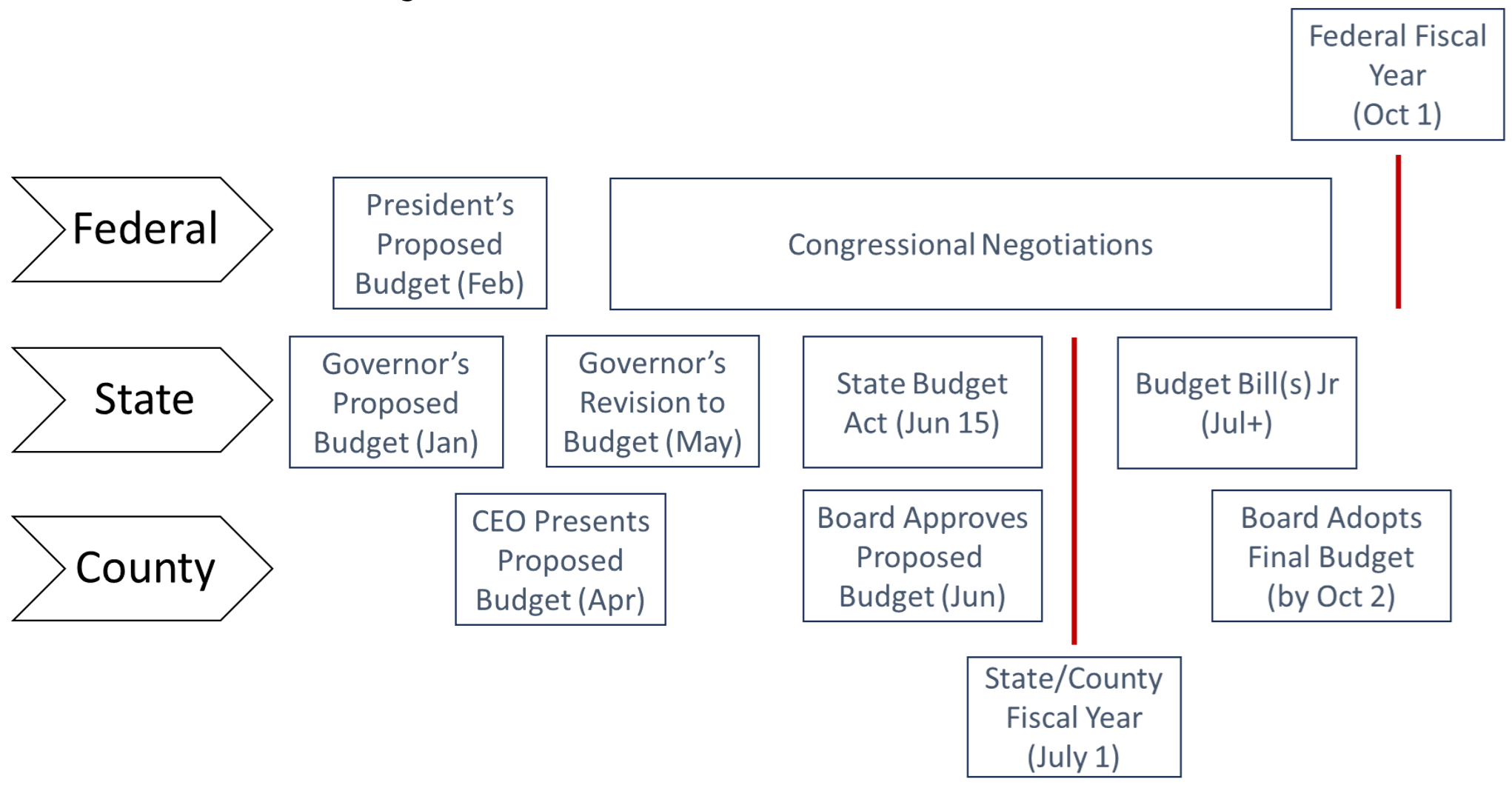

The image below illustrated the County’s budget timelines as compared to the Federal and State budget timelines.

Department Accomplishments and Objectives

Included within the Adopted 2025-26 Budget was an expanded discussion of accomplishments for each department and the progress made on operational plan objectives. Details about these accomplishments were provided by clicking on the tile of the completed or proposed operational plan objective or on the departmental accomplishment.